The US Indices Are Rising Strongly

market news summary

US President Joe Biden signed on Saturday, June 3, a bill to raise the government’s debt ceiling, which stands at $31.4 trillion, thus putting an end to America’s debt default crisis. The members of the US Senate voted on Thursday to raise the debt ceiling with a majority of 63 votes in favor and 36 against.

Ignazio Visco, Governor of the Bank of Italy and member of the European Central Bank said that the rapid decline in energy costs will help curb inflation in Europe. He called on companies not to seek to enhance profit margins by keeping prices high for longer.

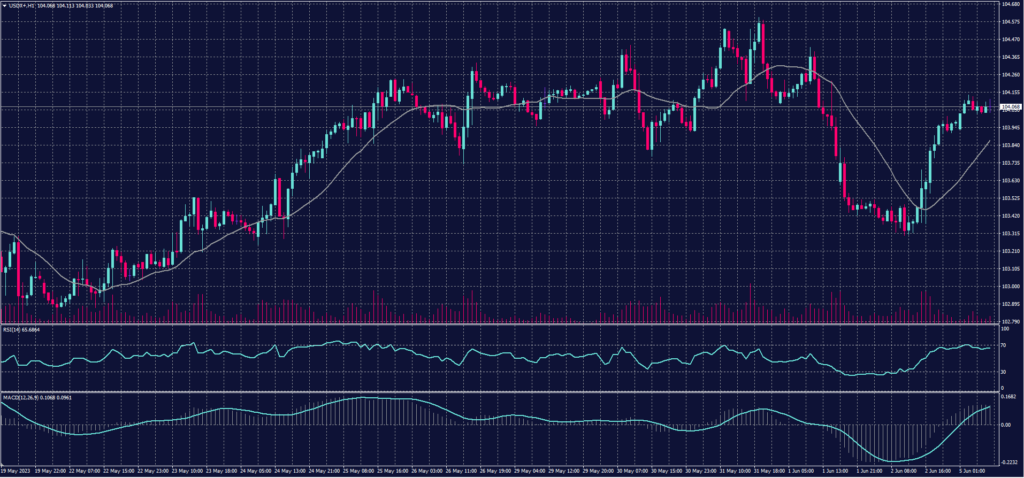

Dollar Index (USDX)

The US dollar index turned higher after the release of the US employment data last Friday, which showed more job additions than expected and higher than the previous reading, along with an increase in the unemployment rate that exceeded expectations and the previous reading.

The dollar index climbed to 104.10 points today after falling on Friday to touch levels of 103.30 points.

Pivot point: 103.75

| Resistance level | Support level |

| 104.20 | 103.50 |

| 104.45 | 103.05 |

| 104.90 | 102.80 |

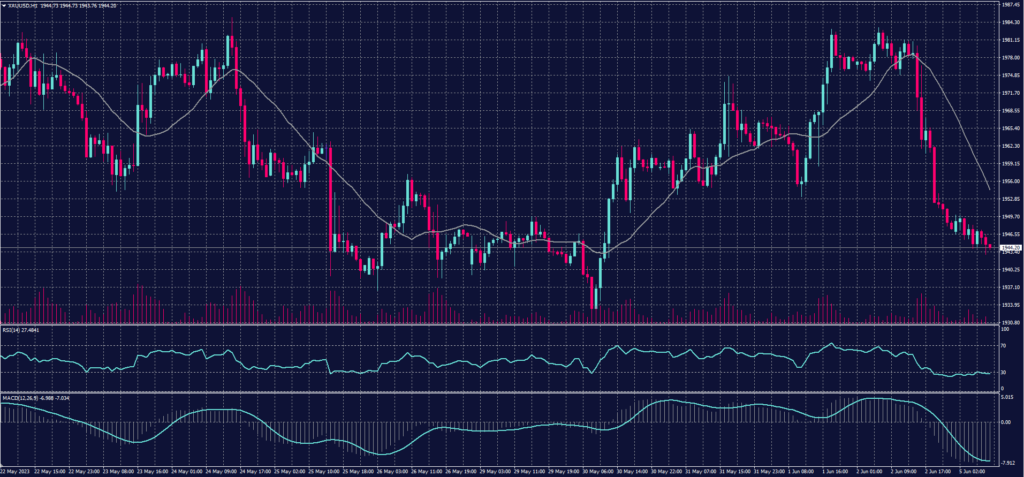

Spot Gold (XAUUSD)

Gold prices declined at the end of Friday’s trading session as better-than-expected employment data led to an increase in Treasury bond yields.

Gold futures fell by 1.3% to close at $1,969.6 per ounce. However, it achieved a weekly gain of 1.3%, marking its best weekly performance since April. But today, gold returned to important support levels at $1,943.

Pivot point: 1959

| Resistance level | Support level |

| 1971 | 1935 |

| 1995 | 1923 |

| 2005 | 1899 |

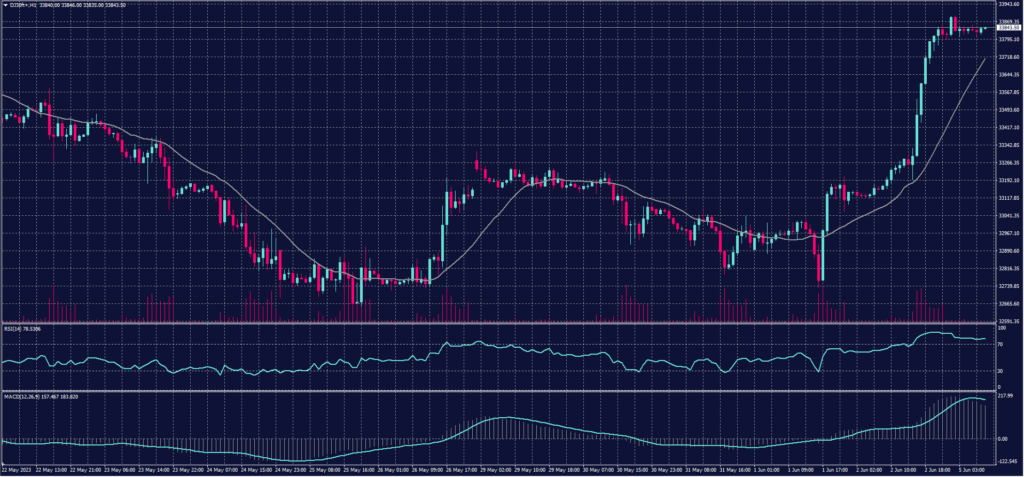

Dow Jones Index (DJ30ft – US30)

US stock indices rose at the end of Friday’s trading session following the release of a strong monthly jobs report and the market’s relief after Congress passed the debt ceiling agreement.

The Dow Jones index jumped by approximately 701.19 points or 2.12% to close at 33,762.76 points. The S&P 500 index also rose by 1.45% to close at 4,282.37 points, while the Nasdaq index increased by 1.07% to reach 13,240.77 points, marking its highest level since April 2022.

Pivot point: 33600

| Resistance level | Support level |

| 34075 | 33335 |

| 34340 | 32855 |

| 34820 | 32595 |

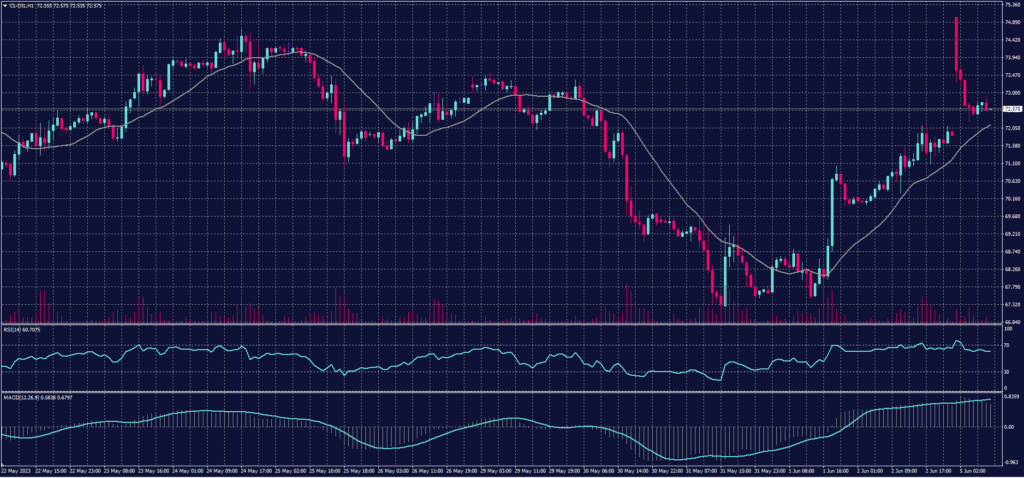

US Crude (USOUSD)

Oil prices jumped more than 2% at the start of the week after Saudi Arabia announced an additional voluntary production cut. The OPEC+ meeting, which concluded on June 4th, agreed to set a new production target of 40.46 million barrels per day starting from 2024 until the end of that year. The alliance also approved extending the voluntary production cut until the end of 2024.

Brent crude futures rose by approximately 2.1% to $77.76 per barrel, while US crude futures surged by 2.16% to $73.29 per barrel.

Pivot point: 71.30

| Resistance level | Support level |

| 72.65 | 70.50 |

| 73.45 | 69.15 |

| 74.80 | 68.35 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.