The Peak of Monetary Tightening Has Not Been Reached Yet

Market News Summary

A U.S. official revealed on Sunday that President Joe Biden will urge Beijing to restore military relations during the upcoming summit with Chinese counterpart Xi Jinping.

Moody’s Investor Services lowered its outlook for the U.S. credit rating from stable to negative, emphasizing on Friday the “very large” financial deficit in America and the partisan gridlock in Washington as contributing factors to the credit rating downgrade.

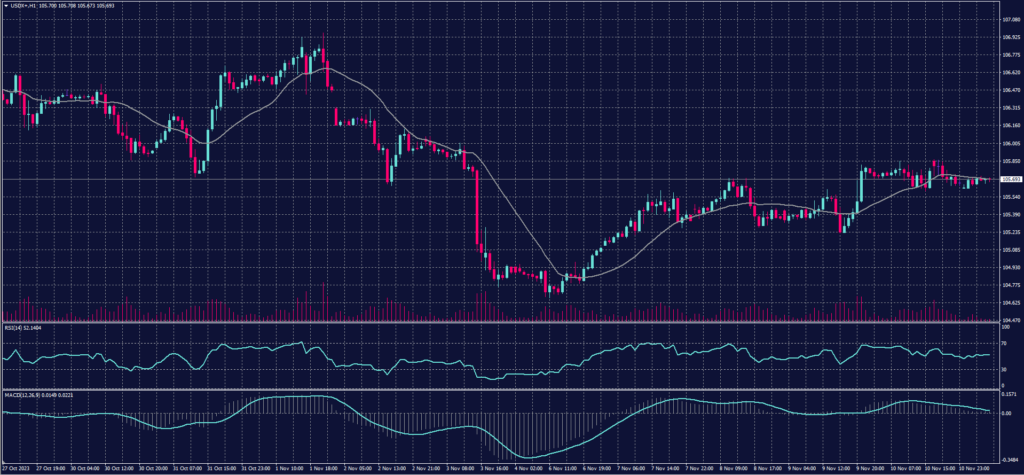

Dollar Index (USDX)

The prices of the dollar index stabilized as investors assessed statements from the U.S. Federal Reserve Chairman Jerome Powell regarding inflation. Powell mentioned that there are positive signs and tangible progress in curbing inflation, but he and his team at the Federal Reserve are concerned that efforts to reduce inflation to 2% may not be sufficient.

The markets interpreted these statements as a signal that the Federal Reserve may take further interest rate hike decisions in the coming period and that the peak of monetary tightening has not been reached yet.

Pivot Point: 105.70

| Resistance level | Support level |

| 105.80 | 105.55 |

| 106.00 | 105.40 |

| 106.10 | 105.25 |

Spot Gold (XAUUSD)

Gold prices declined as investors favored high-risk assets such as stocks and ignored safe havens like

the precious metal. The yield on the 10-year U.S. Treasury bonds stabilized below the 5% threshold

during Friday’s trading.

U.S. gold futures dropped by 1.6% or about $32.10 to settle at $1,937.70 per ounce, resulting in a

weekly loss of 3.1% for the yellow metal.

Pivot Point: 1944

| Resistance level | Support level |

| 1955 | 1927 |

| 1971 | 1916 |

| 1982 | 1899 |

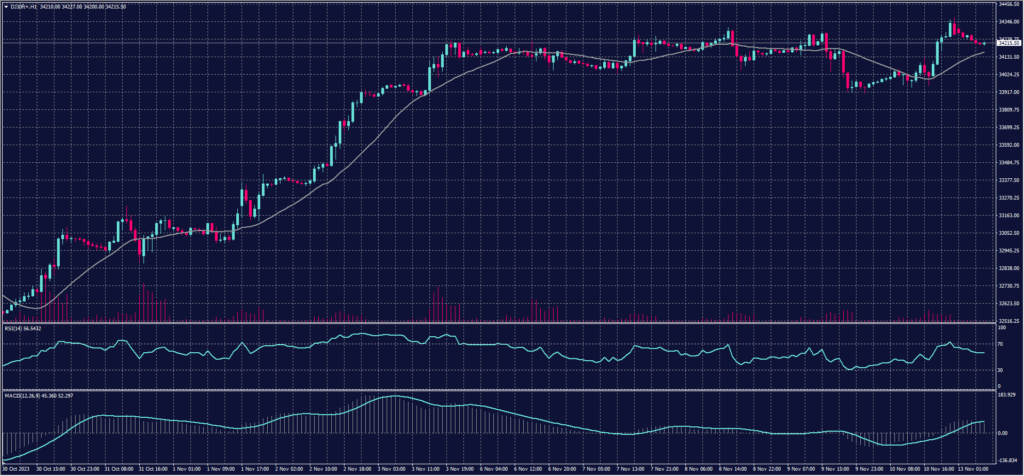

Dow Jones Index (DJ30ft – US30)

U.S. stock futures declined at the beginning of the week on Sunday night, following Moody’s Investor

Services lowering its outlook for the U.S. credit rating from stable to negative.

Futures for the Dow Jones Industrial Average dropped by 48 points, or 0.1%. Futures linked to the S&P

500 and Nasdaq 100 also decreased by 0.1%.

Pivot Point: 34180

| Resistance level | Support level |

| 34455 | 33995 |

| 34640 | 33725 |

| 34910 | 33540 |

US Crude Oil (USOUSD)

Oil prices rose by about 2% at the end of Friday’s trading, with Iraq confirming its commitment to the

production levels set by the OPEC+ alliance. This comes ahead of a meeting the alliance is set to hold

in two weeks. However, prices recorded a weekly decrease of 4%.

Brent crude futures increased by $1.42, equivalent to 1.8%, settling at $81.43 per barrel. West Texas

Intermediate (WTI) crude rose by $1.43, or 1.9%, to $77.17 per barrel at the close.

Pivot Point: 76.80

| Resistance level | Support level |

| 78.25 | 75.85 |

| 79.20 | 74.35 |

| 80.65 | 73.45 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.