The Gold Is Experiencing a Significant Decline, While the U.S. Dollar Remains Stable

Market News Summary

European indices ended Tuesday, December 5, on a high note, following data indicating a slowdown in the decline of business activity in the Eurozone. The STOXX600 European index recorded a 0.40% increase at the end of the session, closing at 467.62 points. German stocks reached a new record level, supported by gains in industrial and insurance company stocks. The German DAX index closed up by about 0.78%. Data also showed an easing decline in the services sector in the Eurozone’s largest economy in November.

In the United States, a new opinion poll conducted by Reuters revealed that the popularity of U.S. President Joe Biden has approached its lowest levels during his presidency this month, indicating challenges ahead for his attempt to be re-elected as president in the upcoming year.

Dollar Index (USDX)

The dollar index declined, heading towards its worst month since a year, while the yields on 10-year Treasury bonds reached their lowest level in two and a half months.

Traders evaluated data that showed a slight increase in U.S. consumer spending in October, while the annual rise in inflation was the lowest since early 2021.

Pivot Point: 103.20

| Resistance level | Support level |

| 103.75 | 102.85 |

| 104.05 | 102.35 |

| 104.35 | 101.95 |

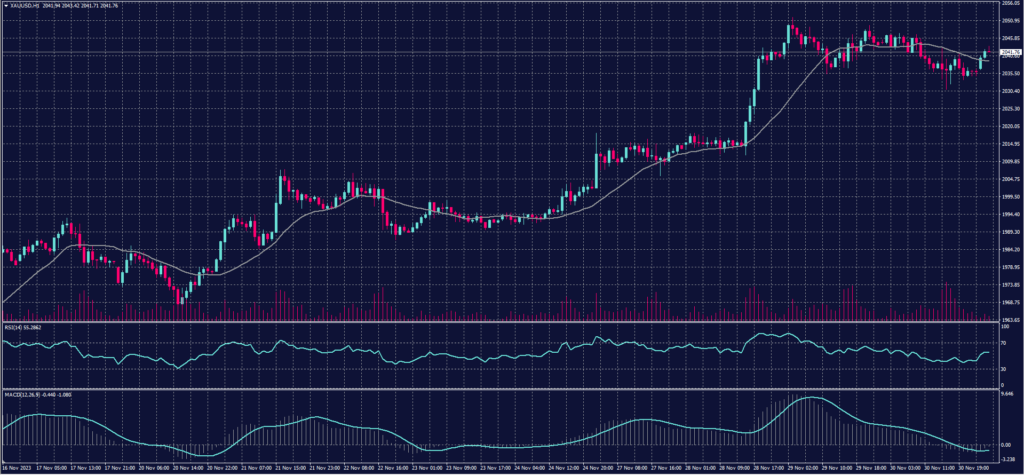

Spot Gold (XAUUSD)

Gold prices fell at the end of Thursday’s trading but still recorded gains for the second consecutive month as expectations increased that the Federal Reserve might cut interest rates soon.

Gold in spot transactions dropped by 0.4% to $2035.79 per ounce after reaching its highest level in almost seven months in the previous session. Gold futures rose by about 2.7% in November.

Pivot Point: 2037

| Resistance level | Support level |

| 2045 | 2028 |

| 2054 | 2021 |

| 2061 | 2012 |

Dow Jones Index (DJ30ft – US30)

The US indices closed mixed on Thursday’s session, but they achieved strong monthly gains supported by rising hopes of easing the Federal Reserve’s policy after a slowdown in inflation rates. The preferred inflation gauge for the Federal Reserve slowed down on a yearly basis in October, raising the likelihood of the central bank ending its tight monetary policy. Data released on Thursday showed a slowdown in the Personal Consumption Expenditures (PCE) index to 3% in October on a yearly basis, after reaching 3.4% in the September reading.

The Dow Jones index jumped by about 1.5%, equivalent to 520 points, in Thursday’s session to close at its highest levels since January 2022, supported by strong gains in Salesforce shares. Throughout the month, the Dow Jones rose by about 9% in November, marking its highest monthly gains since October 2022.

Pivot Point: 35855

| Resistance level | Support level |

| 36150 | 35690 |

| 36320 | 35395 |

| 36615 | 35225 |

US Crude Oil (USOUSD)

Crude oil prices dropped more than 2% yesterday, Thursday, after OPEC+ producers agreed to voluntary oil production cuts in the first quarter of the next year, which fell below market expectations.

Brent crude futures declined by 27 cents, or 0.3%, to $82.83 per barrel at the settlement, marking a monthly loss of 5.2%. Meanwhile, West Texas Intermediate (WTI) crude futures fell by $1.90, or 2.4%, to $75.96 per barrel, registering a 6.2% decrease for the month.

Pivot Point: 76.75

| Resistance level | Support level |

| 78.45 | 73.90 |

| 81.25 | 72.20 |

| 82.95 | 69.35 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.